| Alaska Wires, ACH and Ordering Checks: 125200879 |

Colorado Wires, ACH and Ordering Checks: 307070267 |

| Connecticut ABA (Ordering Checks): 222370440 Wire Transfer & ACH Routing: 021300077 |

Florida Wires, ACH and Ordering Checks: 041001039 |

| Idaho Wires, ACH and Ordering Checks: 124101555 |

Indiana Wires, ACH and Ordering Checks: 041001039 |

| Maine Wires, ACH and Ordering Checks: 011200608 |

Massachusetts Ordering Checks: 222370440 Wire Transfer & ACH: 021300077 |

| Michigan Wires, ACH and Ordering Checks: 041001039 |

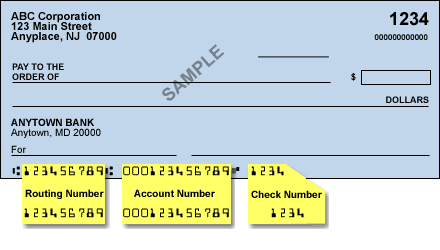

New York Ordering Checks: Please refer to your check, or view in online banking Wire Transfer & ACH: 021300077 |

| Ohio Ordering Checks: Please refer to your check, or view in online banking Wire Transfer & ACH: 041001039 |

Oregon Wires, ACH and Ordering Checks: 123002011 |

| Pennsylvania Ordering Checks: 222370440 Wire Transfer & ACH: 021300077 |

Utah Wires, ACH and Ordering Checks: 124000737 |

| Vermont Wires, ACH and Ordering Checks: 211672531 |

Washington Wires, ACH and Ordering Checks: 125000574 |

| Routing Number | Bank | Address** | State, Zip |

|---|---|---|---|

| 041001039 | KEYBANK | NY-31-17-0119 ALBANY | New York, 12211 |

| 011104173 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 011807043 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 021110209 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 021313569 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 021313747 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 022072692 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 031302272 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 031302803 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 031305253 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 031307468 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 031308564 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 031311810 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 031314749 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 031315382 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 031911812 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 031918527 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 211170088 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 211170130 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 211170185 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 211174369 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 211174990 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 221370616 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 222370440 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 231372170 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |

| 231375575 | KEYBANK NA | NY-31-17-0119 ALBANY | New York, 12211 |